Sometimes, the administrative hurdles you must overcome to obtain tax exempt status, can overshadow the good work you intend to do. Creating a North Carolina nonprofit organization is not difficult, but it is time consuming.

At Fenner's Law, our 'magic formula' for successfully completing IRS Form 1023 is help you draft clear and unambiguous answers. We help you to understand what the IRS expects of you and how you can comfortably meet those expectations.

While the paperwork may be tedious, completing it is well worth the effort. Remember, your organization’s profit will be exempt from tax and your donors will be entitled to a tax subsidy.

Nonprofit Creation

By telephone conference and online questionnaire, we review your organization's purpose, its programs and its eligibility for federal and state tax exemption. We form your North Carolina Nonprofit Corporation.

Helping You To Get You Started

We provide a self-help guide outlining how to run your new nonprofit including the holding board meetings, the taking minutes and the proper handling of donations

"We have eliminated the 'office visit'. Our Online Wills and Estate Planning service offerings can be completed online. More importantly, it can 'easily' be completed online! We dispense with all of the 'lawyer pretense' and 'tech-no-babble' and we offer you a service that you can complete while sitting on the couch."

Robert Fenner

Founder, Fenner's Law, PC

GET READY NOW

While a nonprofit's administrative requirements may seem overwhelming, we do all the boring work. We draft and file your organization's North Carolina Articles of Incorporation to conform to 501 (c)(3) requirements. We apply for your Federal Employee Identification Number and we open your North Carolina State Tax Identification Account. We draft your organization's Bylaws, Conflict of Interest Policy and initial Organizational Meeting Minutes.

Learn MoreWhen you are looking to open a tax-exempt business, information is an important commodity . You will need to develop a marketing strategy. You must determine which state and federal regulations impact your operations. Our free Nonprofit Start-Up Guide is a great place to start.

To engage our firm, we will ask you to review and digitally sign our Legal Services Agreement. Except for its digital format, an online digital signature is legally identical to a handwritten signature. Sign in any browser or mobile device. You will not need to print or fax a single piece of paper.

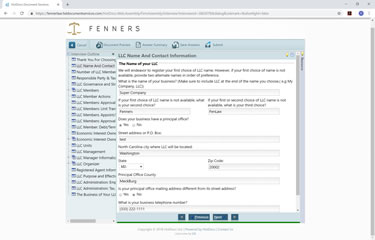

We ask you to complete an online questionnaire. We use your answers to create your Estate documents. Complete our questionnaire at your convenience.

We create you nonprofit and register it with the IRS and the N.C. Secretary of State. We complete IRS Form 1023 and answer any questions you may have. We accept credit cards and debit cards. If you purchase a website, we launch it and provide a tutorial on editing and updating the site. Turn around time for the completion of our service is about 10 working days from receipt of your questionnaire answers.

You have great ideas and you want to help your community. But, the administrative hurdles you must overcome to obtain tax exempt status, can overshadow the good work you intend to do. At Fenner's Law, PC, we make the process of creating your nonprofit easy and stress free.

See What We ChargeWe are:

Experts

Cost Effective

Fast

Easy to deal with

...and much more